Btl mortgage calculator how much can i borrow

How much can I borrow calculator. Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that.

French Mortgage Calculator Frenchentree

Particularly the longer-term fixes which can be around 1 more expensive for buy-to-let versus residential equivalents.

/housecalculator-56a7dc723df78cf7729a0745.jpg)

. There are advantages and disadvantages to all types of. You can make a lot of money from becoming a landlord if you make smart. Screen - Stores the screen size of the device that you are viewing our website on.

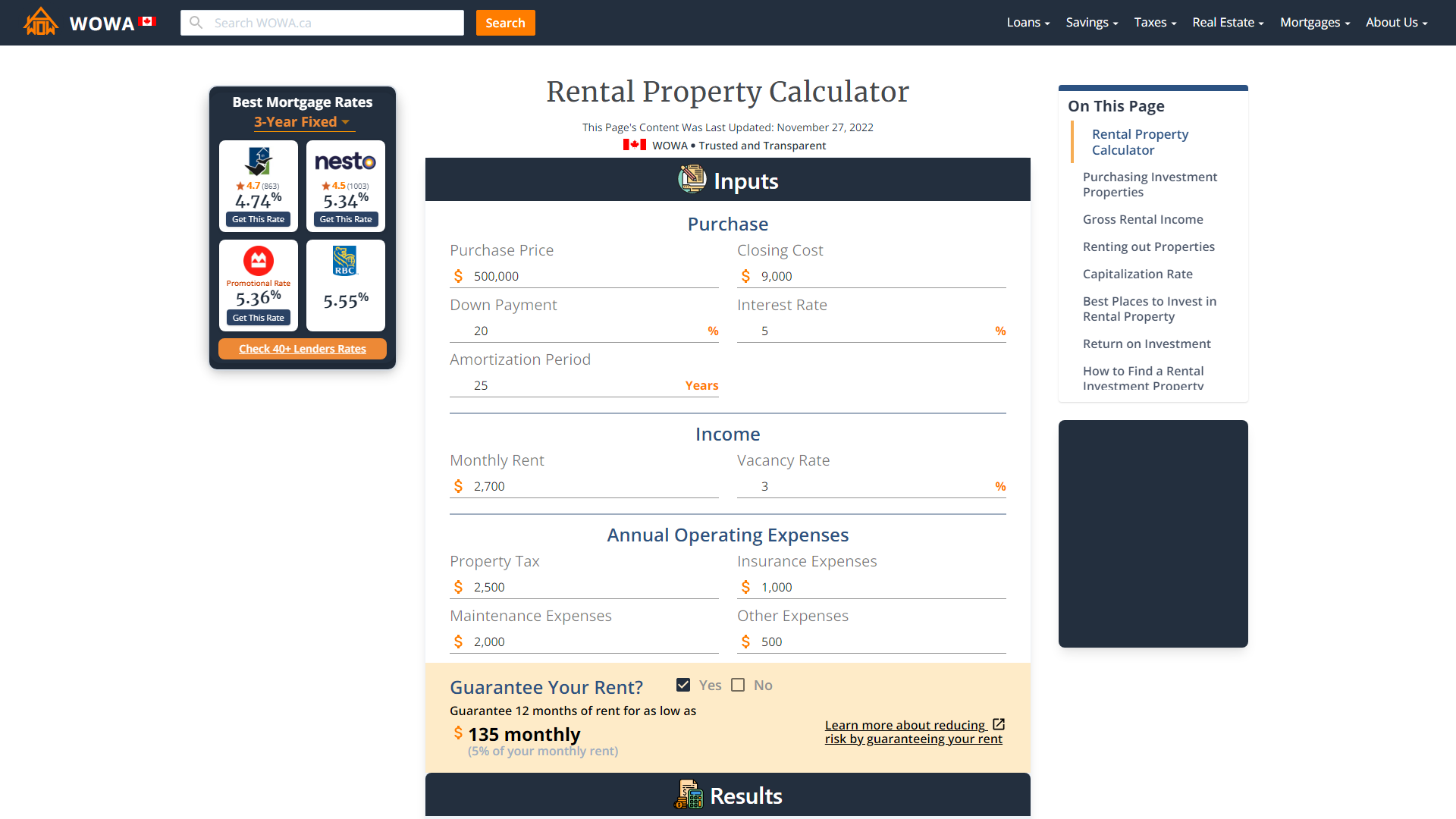

This calculator shows the maximum amount available at the products LTV based on TMWs loan size restrictions. Our buy to let mortgage calculator gives you essential information on interest rates LTV monthly payments how much you can borrow and more. This percentage is interest-free and it is designed to go up to 25000.

First simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years however more lenders are now happy to offer mortgages over periods of up to. Please get in touch over the phone or visit us in branch. Ahloanamt - Stores your mortgage settings for use across the website to pre-populate mortgage calculators.

If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1. A Buy to Let mortgage is a loan secured against one of these properties. The offer is available with immediate effect and is only available through the Current Account Switch Service CASS until 27 June.

A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. However there are some important differences particularly when considering how much you can afford and the size of your deposit. Mortgage Advice Bureau have 1600 UK advisers with 200 awards between them.

Life insurance is not a requirement of our mortgage. The amount you borrow - doesnt reduce and is paid back at the end of the mortgage term via a suitable repayment vehicle usually the sale of the property. You can use our buy to let mortgage calculator to find out what deals you qualify for and how much theyre likely to cost you.

We provide mortgage services to both UK and Foreign National Property Investors looking for Buy to Let property in the UK and we can help even when other lenders have declined applicants. Recent - Stores information of the last pages you have viewed. Loan-to-Value Ratio Qualifications.

It is not an offer of a mortgage. Buy to let BTL mortgages are for landlords who want to buy property to rent it out. The monthly interest payments on a buy-to-let mortgage depend on various factors.

Speak to an award-winning mortgage broker today. THIS SITE IS INTENDED FOR THE USE OF UK MORTGAGE INTERMEDIARIES AND PROFESSIONAL ADVISORS ONLY. Expats Mortgages UK has a comprehensive network of Specialist Expat Mortgage Lenders which we have developed.

The loan-to-value LTV generally needs to be lower than 85. A full Illustration is available on request or online. Loan to Value Calculator.

Our free buy to let calculator gives you quotes for BTL mortgage interest rates monthly repayments and rental yield estimations using basic information such as property value monthly rent and how. What LTD company BTL mortgages are and more. What is a Buy to Let mortgage.

Screen - Stores the screen size of the device that you are viewing our website on. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you. At 50 and 70 LTV the maximum loan amount available may be higher than displayed.

From fixed rate tracker rate to mortgages for greener properties and mortgages with low deposits learn more about your options. Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. Generally a BTL mortgage will be more expensive than the equivalent residential mortgage.

The mortgages below show the best five-year fixed rate buy-to-let mortgage rates available. The move comes after HSBC launched its 170 switch offer last week. If you rent out a property on which you only have a residential mortgage youll be in breach of your mortgage agreement which could put your property.

Loan to value LTV calculator. Call 0808 149 9177 or request a callback. Lloyds Bank will incentivise any customers switching from another bank to its Club Lloyds or Club Lloyds Platinum Account with a 125 cash bonus.

Ahloanamt - Stores your mortgage settings for use across the website to pre-populate mortgage calculators. You can also personalise the chart below by adding the value of the property you want to buy and the value of the mortgage you want to get. Though it can range from 20 to 40.

Compare the different mortgage types and types of mortgage rates that could be a good option for you. All applications are subject to lending policy and product availability. The outstanding loan balance - ie.

Find out more about home insurance here. Military personnel can borrow up to 50 percent of their salaries to buy their first home. Specialist buy to let mortgages.

The maximum amount youre likely to be able to borrow on a BTL mortgage is 75 to 85 of the property value. Like any form of investment theres a lot to consider before you make the jump as. An AIP is a personalised indication of how much you could borrow.

Foundation Home Loans is the home of specialist buy to let mortgages offering criteria to meet a wide range of specialist mortgage needs available to portfolio landlords individual landlords and those buying or remortgaging via Limited Companies. Recent - Stores information of the last pages you have viewed. Home insurance is underwritten by U K Insurance Limited.

Specialist Mortgages for Expat Foreign National Property Investors. This calculator is for guidance purposes only. Here are things to consider with a buy to let mortgage.

Your rental income will need to be above 125 of your monthly mortgage payment so if your mortgage is 1000 your rent will need to be at least 1250. In some instances eg. Mortgage - Stores your mortgage settings for use across the website.

Mortgage - Stores your mortgage settings for use across the website. Having buildings insurance is a condition of our mortgage offer but you dont need to buy it through Royal Bank of Scotland and it doesnt affect how much well lend you. These include the size of your initial loan the rental value of your property and your own financial situationHowever it will also heavily depend on what type of loan you take out be it a fixed rate or variable rate mortgage.

Applying for a buy to let mortgage is a fairly similar process to a residential mortgage application. On top of 125 for. How Much Can I Borrow.

Calculate loan to value. It will not impact your credit score and takes less than 10 minutes. Most BTL loans are structured as interest-only.

The results shown are for interest-only but you can amend this using the filter on the chart. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Right to Buy Calculator.

Mortgage Pre Approval What Are The Advantages Buy To Let Mortgage Preapproved Mortgage Mortgage

Mortgage Calculator Centre Mortgages Bank Of Ireland

Pin On Data Vis

Lzbw6a1vckffem

British Columbia Bc Mortgage Calculator Best Rate 4 54

Property118 How To Calculate The Amount You Can Borrow On A Buy To Let Mortgage

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

Your Ultimate Spanish Mortgage Calculator What Is The Cost Of Your Spanish Mortgage How To Buy In Spain

Mortgage Calculator

Try One Of Our Mortgage Calculators Haysto

:max_bytes(150000):strip_icc()/image1-88531da28fef40278a045820003c3777.png)

Mortgage Calculator

Let To Buy Calculator

Free Interest Only Loan Calculator For Excel

/housecalculator-56a7dc723df78cf7729a0745.jpg)

Mortgage Calculator

How Much Will My Mortgage Cost Calculator

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Komentar

Posting Komentar